A GPS-Based Alternative to Fuel Tax

If you’re one of the many people who have purchased a different vehicle as part of a way to cut your monthly expenditures on gasoline, then you’re probably not going to like Oregon Governor Ted Kulongoski’s latest idea: In light of the decrease in gasoline tax revenue due to more fuel efficient vehicles and people driving less, Kulongoski is proposing a mileage tax that will use GPS to determine how far you’ve traveled.

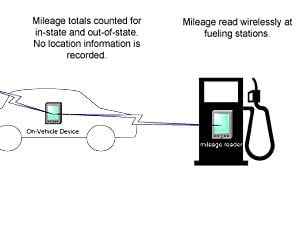

Of course, there’s much resistance to this proposal, including the worry that it would be an invasion of privacy. Recognizing that most of us wouldn’t be too keen on the government tracking our every move, the proposed system in Oregon doesn’t track any travel points. Instead, mileage is read when drivers head to the pumps for a refill. When drivers fill up, they would be charged a tax of 1.2 cents per mile.

Of course, there’s much resistance to this proposal, including the worry that it would be an invasion of privacy. Recognizing that most of us wouldn’t be too keen on the government tracking our every move, the proposed system in Oregon doesn’t track any travel points. Instead, mileage is read when drivers head to the pumps for a refill. When drivers fill up, they would be charged a tax of 1.2 cents per mile.

Doing the math, someone who drives 15,000 miles annually would pay $180 in mileage tax. By comparison, a car that averages 25 mpg and travels 15,000 miles per year would pay $144, based on Oregon’s current fuel tax of 0.24 cents per gallon.

Since Kulongoski lacks the power to enforce a mileage tax, he’s relying on the Oregon legislature to make it a law. Given that it would take some time (and money) to equip all vehicles with a GPS device, the standard gas tax would remain in effect for the foreseeable future, and could possibly increase by two cents per gallon. Early adopters of the GPS-based tax would receive a refund for gas taxes paid.

Since Kulongoski lacks the power to enforce a mileage tax, he’s relying on the Oregon legislature to make it a law. Given that it would take some time (and money) to equip all vehicles with a GPS device, the standard gas tax would remain in effect for the foreseeable future, and could possibly increase by two cents per gallon. Early adopters of the GPS-based tax would receive a refund for gas taxes paid.

While none of us get excited about paying taxes, we still have to recognize that the money to pave and repair our roads has to come from somewhere. Whether or not a mileage-based tax is the solution is arguable.