AMD's Smoking Hot Data Center Group Props Up Earnings As Game Console Stagnation Sets In

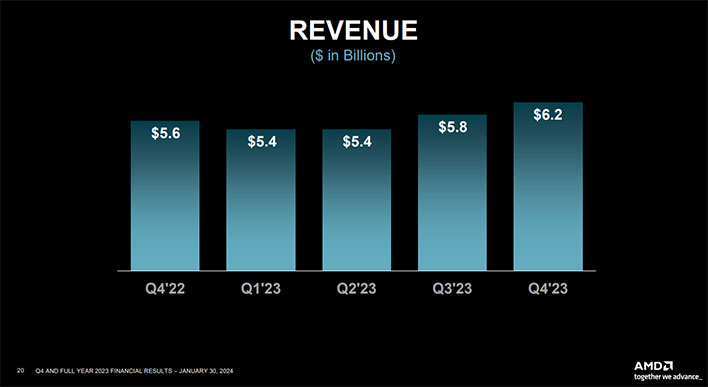

All things considered, AMD ended its fiscal year on a high note with its fourth quarter (of 2023) revenue coming in at $6.2 billion, for a quarterly profit of $667 million. For the full year, AMD reported revenue of $22.7 billion, with net income tallying $854 million. The figures are largely the result of impressive gains in AMD's data center division, driven by demand for its high-end EPYC processors and Instinct GPUs.

Just as importantly, AMD's data center performance underscores that CEO Dr. Lisa Su has the company in solid position to leverage the burgeoning artificial intelligence (AI) market. And by extension, that means customers are not exclusively invested in competing solutions from NVIDIA and Intel, suggesting there's plenty of room for the major chip players to all participate.

"We finished 2023 strong, with sequential and year-over-year revenue and earnings growth driven by record quarterly AMD Instinct GPU and EPYC CPU sales and higher AMD Ryzen processor sales," Dr. Su said in a statement. "Demand for our high-performance data center product portfolio continues to accelerate, positioning us well to deliver strong annual growth in what is an incredibly exciting time as AI re-shapes virtually every part of the computing market."

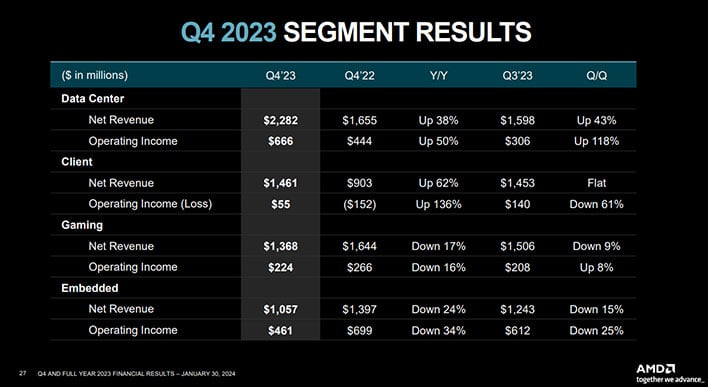

AMD generated nearly $6.5 billion in data center revenue during 2023, which represents a 7% increase year-over-year. The data center really hit its stride in the fourth quarter, increasing 43% sequentially and 38% year-over-year to a bit over $2.28 billion. That's a good sign for AMD going forward.

Meanwhile, AMD's client revenue for the fourth quarter reached $1.46 billion, which is flat sequentially and up a monstrous 62% year-over-year. AMD credits the performance to a increase in demand for its Ryzen 7000 series CPUs based on Zen 4. Looking at sales for the entire year, however, AMD's client group revenue was down 25% to $4.65 billion (versus $6.2 billion).

While AMD ended the year on high notes in its client and data center divisions, its gaming division took a hit—fourth quarter revenue fell 9% sequentially and 17% year-over-year to $1.46 billion. And for the full year, gaming revenue fell 9% to $6.21 billion (from $6.81 billion).

This wasn't due to a drop in demand for its Radeon GPUs. In fact, according to AMD, its Radeon GPU sales partially offset the real culprit, which is a decrease in semi-custom revenue. That basically boils down to silicon built for game consoles, like the PlayStation 5 and Xbox Series X|S. Both of those have been on the market since 2020, so it's fair to say there's been a bit of console stagnation at this point, especially with the lack of upgraded refreshes (Sony released a PS5 Slim, but the core hardware is essentially the same).

Looking ahead, AMD is banking on its recently-launched Instinct MI300 accelerator family to keep the momentum going in the AI space, with Dr. Su saying during an earnings call that the early customer response has been "overwhelmingly positive." Dr. Su also laid claim to "Ryzen CPUs power[ing] more than 90% of AI-enabled PCs currently on the market."

We suspect that will change in short order as Intel's Meteor Lake solutions build up momentum, but that's a discussion for another quarter.

"We are aggressively driving our Ryzen AI CPU roadmap to extend our AI leadership, including our next-gen Strix processors that are expected to deliver more than three times the AI performance of our Ryzen 7040 series processors. Strix combines our next-gen, Zen 5 core with enhanced RDNA graphics and an updated Ryzen AI engine to significantly increase the performance, energy efficiency and AI capabilities of PCs," Dr. Su added.

The first notebooks to feature AMD's Strix processors will launch this year. Dr. Su also said that AMD's MI300 solutions are on track to become the "fastest revenue ramp of any product" in the company's history.

Interestingly, AMD's stock price is down in early morning trading even though its fourth quarter earnings beat out revenue estimates. What gives? It's likely due to AMD's softer-than-expected forecast of $5.4 billion, plus or minus $300 million, for the first quarter of 2024, versus Wall Street's $5.73 billion estimated figure.