AMD Posts Record Revenue On EPYC Data Center Momentum Even As PC Market Stalls

During an earnings call with analysts, AMD CEO Dr. Su noted, "We remain very bullish about our data center business," and it's easy to see why. Just days after rival Intel posted a brutal earnings report in which it suffered one of its biggest quarterly losses in history and a 20 percent drop in full-year revenue, AMD announced it just capped off a record year.

"2022 was a strong year for AMD as we delivered best-in-class growth and record revenue despite the weak PC environment in the second half of the year," Dr. Su said in a statement. "We accelerated our data center momentum and closed our strategic acquisition of Xilinx, significantly diversifying our business and strengthening our financial model."

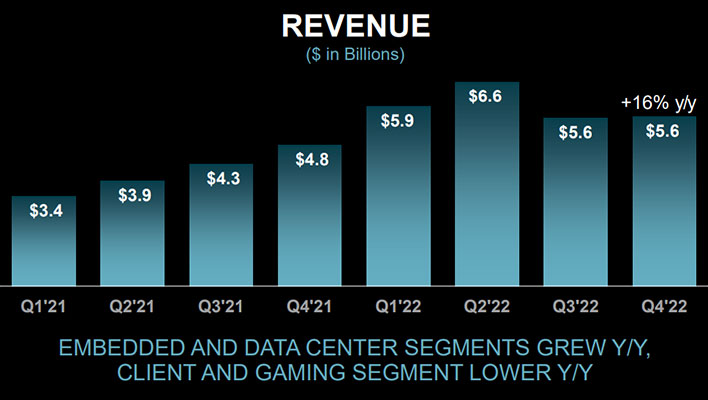

AMD's revenue in the fourth quarter tallied $5.6 billion, up 16 percent versus the same quarter a year ago, while its full-year earnings shot up 44 percent to $23.6 billion. Those are impressive gains when you consider how the PC market essentially stalled out in the second half of year, and in light of Intel's numbers in those same categories being down 32 percent and 20 percent, respectively.

Of course, when put in the context of which company had more sales, Intel wins hands down—its fourth quarter revenue tallied $14 billion while its full-year sales topped $63 billion, the latter of which is around two and a half times higher than AMD.

Nevertheless, the longer-form story here is that AMD continues to chip away at Intel's dominant position, even when (or especially when) the market as a whole finds itself it a bit of disarray.

"Although the demand environment is mixed, we are confident in our ability to gain market share in 2023 and deliver long-term growth based on our differentiated product portfolio," Dr. Su added.

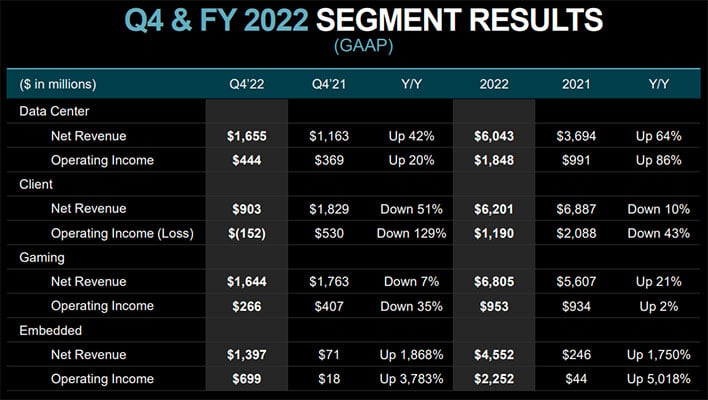

In terms of profit, AMD's net income for the fourth quarter was $21 million, which is down a significant 98 percent year-over-year (albeit in large part "due to the amortization of intangible assets associated with the Xilinix acquisition"). Its full-year net income, however, climbed 60 percent to more than $1.1 billion. The key driver was AMD's data center business, which posted $1.6 billion in the fourth quarter and a little over $6 billion for the full year, versus $3.7 billion for all of 2021.

Dr. Su said the feedback AMD received on its 4th Gen EPYC "Genoa" processors has been "very strong" and that there's an opportunity in 2023 to increase the company's market share. She's also confident in AMD's ability to carve out a larger slice of the embedded category, which grew a staggering 1,868 percent year-over-year.

"Our overall embedded business continues to do well...we had records in communications, industrial and healthcare, aerospace and defense, automotive. We have the embedded processor content that's also going into automotive. So we feel very good about that business," Dr. Su said during AMD's earnings call.

The data center and embedded categories are key drivers that helped offset declines in AMD's client and gaming segments. Client-based revenue fell 51 percent year-over-year to $903 million, which the chip designer attributed to a decline in processor shipments from a "weak PC market and a significant inventory correction" permeating the PC supply chain.

Meanwhile, AMD saw its gaming segment slide 7 percent year-over-year to $1.6 billion due to a dip in graphics card sales. The decline could have been even bigger, but was partially offset by AMD's semi-custom product revenue—AMD notably supplies the CPU and GPU hardware in the PlayStation 5 and Xbox Series X|S consoles.

Looking past its latest earnings report, AMD expects its first quarter revenue for 2023 to settle at around $5.3 billion, plus or minus $300 million, which would be a decrease of around 10 percent. It also expects further declines in its client and gaming segments, and again anticipates those drops being partially offset by continued growing its data center and embedded divisions.