Bitcoin Shares Crash, Lose Over 50 Percent In A Matter of Hours

Of all the current Internet curiosities, Bitcoin is one of the most fascinating. The digital/virtual currency is decentralized, has no change fees, and no state oversight to speak of, and nobody seems to know exactly what to do with it even as it grows in popularity and value.

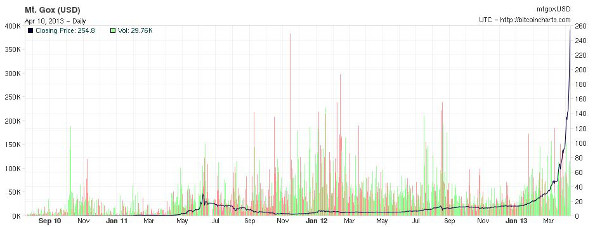

Case in point: On Mt. Gox, a major Bitcoin trading site, the value of Bitcoin exploded from about $100 to $265 in less than a day. Before the day was out, however, the price dropped sharply to $200. A few hours hence saw the value bottom out at $125 and then bounce around from to $180 to $140.

Then, Mt. Gox got hit with a DDoS attack--or maybe not. According to Mt. Gox, it was a victim of its own success. You can sense the PR spin in this update the site posted, complete with a cheerful exclamation point. (Try to ignore the spelling and grammatical errors):

“Indeed the rather astonishing amount of new account opened in the last few days added to the existing one plus the number of trade made a huge impact on the overall system that started to lag. As expected in such situation people started to panic, started to sell Bitcoin in mass (Panic Sale) resulting in an increase of trade that ultimately froze the trade engine!”

The look says it all; there's no meme text to add

The fact of the matter is that the Internet is still in many ways a Wild West, and Bitcoin is an emerging currency in that untamed frontier, which is to say that there are no banking or government institutions behind it. You can collect and spend--and, to follow the above analogy, prospect--Bitcoins, but you can from the events of the last couple of days how tenuous the whole thing still is.

Case in point: On Mt. Gox, a major Bitcoin trading site, the value of Bitcoin exploded from about $100 to $265 in less than a day. Before the day was out, however, the price dropped sharply to $200. A few hours hence saw the value bottom out at $125 and then bounce around from to $180 to $140.

Then, Mt. Gox got hit with a DDoS attack--or maybe not. According to Mt. Gox, it was a victim of its own success. You can sense the PR spin in this update the site posted, complete with a cheerful exclamation point. (Try to ignore the spelling and grammatical errors):

“Indeed the rather astonishing amount of new account opened in the last few days added to the existing one plus the number of trade made a huge impact on the overall system that started to lag. As expected in such situation people started to panic, started to sell Bitcoin in mass (Panic Sale) resulting in an increase of trade that ultimately froze the trade engine!”

The look says it all; there's no meme text to add

The fact of the matter is that the Internet is still in many ways a Wild West, and Bitcoin is an emerging currency in that untamed frontier, which is to say that there are no banking or government institutions behind it. You can collect and spend--and, to follow the above analogy, prospect--Bitcoins, but you can from the events of the last couple of days how tenuous the whole thing still is.