Despite Yield Problems, GPU Sales Surged in Q4 2009

Data from Jon Peddie Research confirms the positive GPU sales information we've heard from AMD of late, with the GPU market as a whole growing by 14.7 percent in Q4 as compared to Q3, and 10.3 percent for the entire year. Intel led the quarter in both market share and increased unit shipments, thanks partially to the joint impact of Atom chipset sales and its new Clarkdale processors, which JPR is calling CIGs (CPU integrated graphics.) Since Intel effectively owns both categories and Atom's effect on the mobile market has been additive rather than disruptive, Intel's overall volume was boosted for the period in question. In future quarters, Intel's CIG graphics shipments are expected to commensurately reduce its IGP sales, particularly as the company phases out the Core 2 Duo product lines.

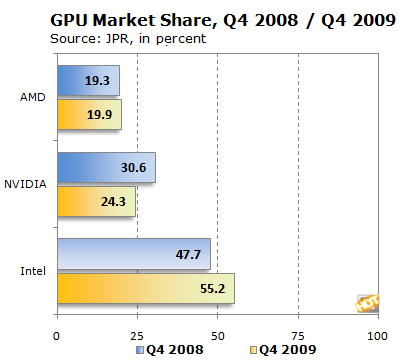

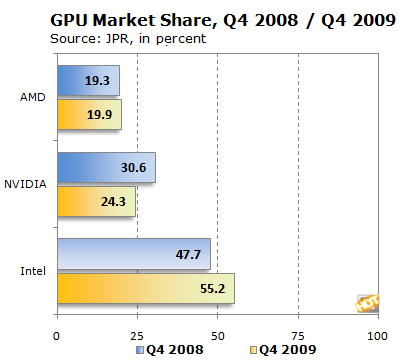

Market share percentages and year-on-year shifts for the top three GPU manufacturers are shown below.

All three vendors increased their total volume of shipments in absolute terms, including NVIDIA. Despite the company's 6.3 percentage point loss of market share, its total unit volume grew 47.3 percent year-on-year. AMD's ratio was even better—while Sunnyvale captured just 0.6 percentage points of additional market share, its unit volume was up 91.5 percent.

Broken down by form factor, AMD gained integrated mobile GPU market share but slipped in discrete in both desktop and mobile. NVIDIA's share of the discrete desktop market grew in the fourth quarter, despite the fact that both companies have been hamstrung by TSMC's yield problems at 40nm, but Team Green reportedly lost ground in both the desktop and laptop integrated markets.

The 2009 sales figures mark the eighth straight year of volume growth in the GPU market, from a total of 180.6 million graphics chips shipped in 2002 up to 425.4 million in 2009.

Market share percentages and year-on-year shifts for the top three GPU manufacturers are shown below.

Broken down by form factor, AMD gained integrated mobile GPU market share but slipped in discrete in both desktop and mobile. NVIDIA's share of the discrete desktop market grew in the fourth quarter, despite the fact that both companies have been hamstrung by TSMC's yield problems at 40nm, but Team Green reportedly lost ground in both the desktop and laptop integrated markets.

The 2009 sales figures mark the eighth straight year of volume growth in the GPU market, from a total of 180.6 million graphics chips shipped in 2002 up to 425.4 million in 2009.