Foxconn Profits Plummet As iPhone Sales Disappoint: Is This The New Normal?

Foxconn is Apple's major manufacturing partner, and has ridden Cupertino's coattails to excellent year-on-year profit growth, even as its employees opted to take flying leaps from its manufacturing centers. The two companies are intertwined to the point that Apple products now account for between 60-70 percent of Foxconn's total revenue. That linkage leaves the Chinese manufacturer open to dips in Apple product sales as well, which is why the 19% drop in Q1 revenue has investors worried.

"A quarterly decline was expected, but not a yearly decline," KGI Securities analyst Ming-chi Kuo told Reuters. "This shows that Hon Hai's revenue depends too much on Apple, and iPhone orders corrected more than expected."

Some have greeted the downturn with optimistic predictions of "They'll have a new phone soon!" while others go for the dour "Apple could be losing its smartphone dominance." The truth is a little more complex.

Yearly launch cycles a poor match for upgrade market

T-Mobile may have launched a bold new experiment in cell phone purchases last month, with its no-contract, no-subsidy offer for the iPhone 5, but the vast majority of customers are locked in to two-year contracts. If you bought the original iPhone in 2007 and have upgraded every year thereafter, your next update won't hit until this summer. Up until now, Apple has boosted sales despite this trend thanks to aggressive user adoption and customers willing to pay full price. In the long run, this wasn't going to last. As smartphones become ubiquitous, the customer base driving sales shifts from first-time adopters to upgrade purchases.

The other problem (at least for investors wanting to see huge returns) is that it's not clear where Apple can take the smartphone from here. The original device debuted touch screens. The 3G added 3G capabilities, the 3GS substantially increased the phone's performance. The iPhone 4 had a beautiful screen, the 4S was faster, came with Siri support, and fixed the 4's antenna problems if you lived in a 3G area. If you didn't (and I don't), the phone continues to have problems.

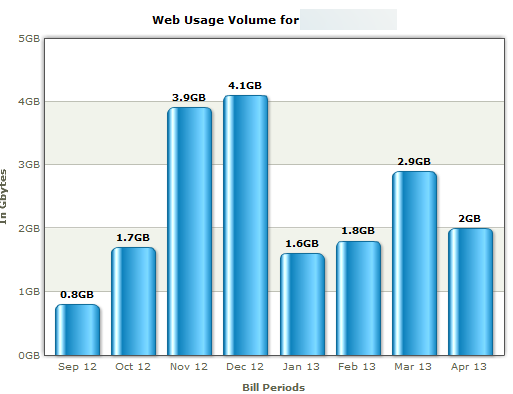

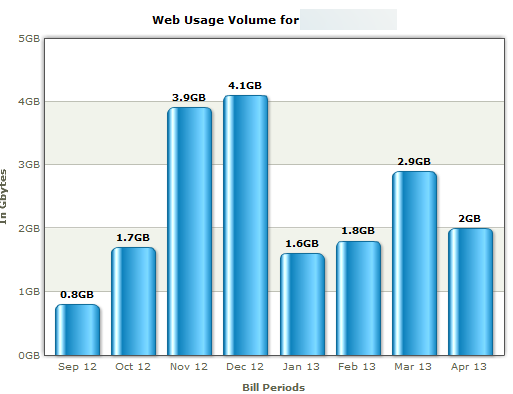

Then the iPhone 5 came out. It's faster, had a 16:9 screen that Apple tried to sell as a revolutionary design element, supports LTE, swapped out a proven Maps engine for Apple's piece of garbage (at launch), and introduced data usage bugs that caused network bandwidth consumption to skyrocket. We covered this at the time, but you can see the before-and-after clearly in data consumption on my own phone.

With Verizon and AT&T pushing metered bucket plans at $10-$15 per GB, this was the sort of mistake that cost people money.

Was the iPhone 5 an upgrade over the 4S? Yes. And eight months after Apple released it, I might finally recommend someone buy one, now that the kinks are worked out. But there's nothing here to get enormously excited over. Apple could add a higher-resolution screen, or better battery life, or a faster processor. It could revamp iOS, or toss in faster LTE. There are definitely ways it can improve the product, but precious few of them are likely to be game-changing the way the previous models were.

It's not so much that Apple is losing dominance, but that smartphones and their capabilities have generally hit a plateau. And it's only bad news if you expected the meteoric rate of return to last forever. Tablets and smartphones are becoming part of the computing landscape, but the adoption process for a product always follows a certain curve. Frankly, I'd rather see Apple take longer on its next iteration and deliver a product that wasn't plagued by broken software and data eating network bugs.

"A quarterly decline was expected, but not a yearly decline," KGI Securities analyst Ming-chi Kuo told Reuters. "This shows that Hon Hai's revenue depends too much on Apple, and iPhone orders corrected more than expected."

Some have greeted the downturn with optimistic predictions of "They'll have a new phone soon!" while others go for the dour "Apple could be losing its smartphone dominance." The truth is a little more complex.

Yearly launch cycles a poor match for upgrade market

T-Mobile may have launched a bold new experiment in cell phone purchases last month, with its no-contract, no-subsidy offer for the iPhone 5, but the vast majority of customers are locked in to two-year contracts. If you bought the original iPhone in 2007 and have upgraded every year thereafter, your next update won't hit until this summer. Up until now, Apple has boosted sales despite this trend thanks to aggressive user adoption and customers willing to pay full price. In the long run, this wasn't going to last. As smartphones become ubiquitous, the customer base driving sales shifts from first-time adopters to upgrade purchases.

The other problem (at least for investors wanting to see huge returns) is that it's not clear where Apple can take the smartphone from here. The original device debuted touch screens. The 3G added 3G capabilities, the 3GS substantially increased the phone's performance. The iPhone 4 had a beautiful screen, the 4S was faster, came with Siri support, and fixed the 4's antenna problems if you lived in a 3G area. If you didn't (and I don't), the phone continues to have problems.

Then the iPhone 5 came out. It's faster, had a 16:9 screen that Apple tried to sell as a revolutionary design element, supports LTE, swapped out a proven Maps engine for Apple's piece of garbage (at launch), and introduced data usage bugs that caused network bandwidth consumption to skyrocket. We covered this at the time, but you can see the before-and-after clearly in data consumption on my own phone.

With Verizon and AT&T pushing metered bucket plans at $10-$15 per GB, this was the sort of mistake that cost people money.

Was the iPhone 5 an upgrade over the 4S? Yes. And eight months after Apple released it, I might finally recommend someone buy one, now that the kinks are worked out. But there's nothing here to get enormously excited over. Apple could add a higher-resolution screen, or better battery life, or a faster processor. It could revamp iOS, or toss in faster LTE. There are definitely ways it can improve the product, but precious few of them are likely to be game-changing the way the previous models were.

It's not so much that Apple is losing dominance, but that smartphones and their capabilities have generally hit a plateau. And it's only bad news if you expected the meteoric rate of return to last forever. Tablets and smartphones are becoming part of the computing landscape, but the adoption process for a product always follows a certain curve. Frankly, I'd rather see Apple take longer on its next iteration and deliver a product that wasn't plagued by broken software and data eating network bugs.