Fusion-io Files IPO, Could Definitely Shake Up Flash Storage Market

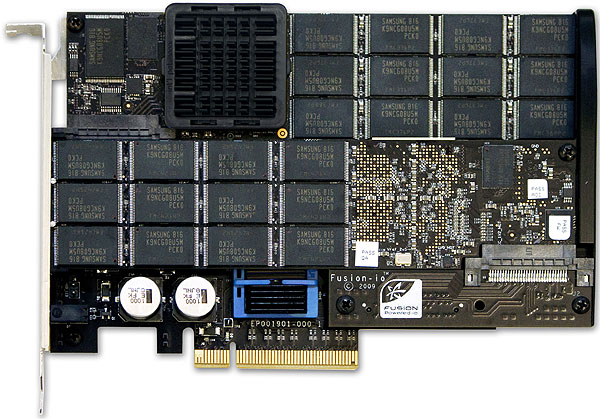

Well, this isn't completely unexpected. Fusion-io, a company that has

been on a rapid growth pattern for years now in the flash storage

market, has just reached the end of their term as a privately held

company. Or, they will soon. Today, the outfit announced that it has

filed a registration statement on Form S-1 with the U.S. Securities and

Exchange Commission (SEC) for a proposed initial public offering of

shares of its common stock. This is the same company for which Steve

Wozniak (Apple's co-founder) is acting in an advisory role has just

issued their intentions to go public, and that could mean very big

things ahead.

As of now, there has been no decision made as to the quantity of shares, nor the price at which they'll be offered. But either way, this is a huge step for Fusion-io. Those who were fans of their innovation have to be concerned about the pull and lobbying of future shareholders, but hopefully that start-up spirit will remain in tact. We really hope this allows Fusion-io to reach a scale where they can charge more reasonable prices for their products, potentially getting them into the hands of more consumers versus just corporations and enterprises. We'll have to wait and see, but in our opinion, this is awesome news. Innovation in the flash market is badly needed, and based on prior experience with their products, they have what it takes to really shake things up.

As of now, there has been no decision made as to the quantity of shares, nor the price at which they'll be offered. But either way, this is a huge step for Fusion-io. Those who were fans of their innovation have to be concerned about the pull and lobbying of future shareholders, but hopefully that start-up spirit will remain in tact. We really hope this allows Fusion-io to reach a scale where they can charge more reasonable prices for their products, potentially getting them into the hands of more consumers versus just corporations and enterprises. We'll have to wait and see, but in our opinion, this is awesome news. Innovation in the flash market is badly needed, and based on prior experience with their products, they have what it takes to really shake things up.

Fusion-io Files Registration Statement for Initial Public Offering

Salt Lake City, Utah – March 9, 2011 – Fusion-io, Inc. announced today that it has filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission (SEC) for a proposed initial public offering of shares of its common stock. The number of shares to be offered and the price range for the offering have not yet been determined.

Goldman, Sachs & Co. and Morgan Stanley & Co. Incorporated are acting as lead active joint book-runners for the proposed offering, and J.P. Morgan Securities LLC and Credit Suisse Securities (USA) LLC are acting as passive joint book-runners.

The offering will be made only by means of a prospectus. A copy of the preliminary prospectus, when available, may be obtained from the offices of Goldman, Sachs & Co.,Attention: Prospectus Department, 200 West Street, New York, NY 10282, telephone: 1-866-471-2526, facsimile: 212-902-9316 or by emailing prospectus-ny@ny.email.gs.com, or Morgan Stanley & Co. Incorporated, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, New York 10014, by phone at 866-718-1649, or by email at prospectus@morganstanley.com.

A registration statement relating to the securities has been filed with the SEC but has not yet become effective. The securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.