IDC Reports Record PC Shipments, Lower Revenue in 2009

The business analysis firm IDC has released data on the shape of the PC industry through the fourth quarter of 2009 and the results point towards a general recovery in all segments. Sales rose moderately in Q4 as compared to Q3, partly thanks to seasonal trends, but were up a full 31.3 percent over Q4 2009. The first half of 2009 was a downright rotten period for virtually every company in the hardware business, but a strong second half boosted total PC sales for the year up 2.5 percent from 2008. Even that small increase, however, came at a price—total PC revenue declined 7.1 percent, to stand at $28.6 billion.

"Compared to 3Q09, the modest rise in shipments in 4Q09 indicates that the market is returning to normal seasonal patterns,” said Shane Rau, director of Semiconductors: Personal Computing research at IDC. "Compared to 4Q08, the huge rise in shipments indicates that the market has put the recession behind it. Both comparisons indicate that the PC industry anticipates improvement in PC end demand in 2010.”

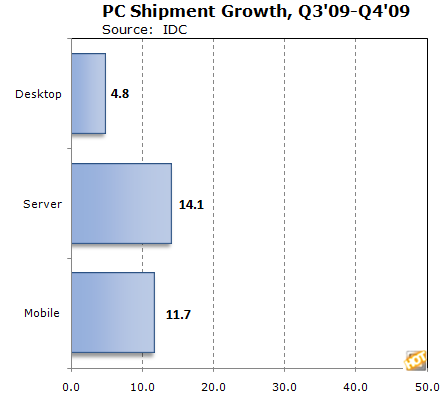

IDC's data matches statements we heard from both AMD and Intel on the current shape of the market. While all three segments grew, desktops lagged well behind mobile parts. The rise in server shipments caps a weak year in which consumer spending, not corporate refresh cycles, drove PC sales. This shift would also account for the drop in overall revenue; OEM margins tend to be significantly higher on business products than their home-oriented counterparts.

AMD apparently grabbed a bit of market share from Intel in Q4, thanks to improved product positioning and better mobile offerings, but Intel continues to dominate both mobile and workstation sales, with nearly 90 percent of both markets. One of the key components of AMD's antitrust suit against Intel was that the larger company used predatory pricing tactics to force AMD out of the more lucrative server and mobile arenas by refusing to offer highly discounted prices unless an OEM agreed to either purchase the vast majority of its CPUs from Intel (~90 percent) or agreed to delay/kill AMD products that might have otherwise competed. Now that the two companies have resolved their dispute and Intel has agreed not to engage in such practices, we may see Sunnyvale's market share edge upwards.

At present, IDC projects a return to seasonal trends for 2010 and expects the market to grow by about 15 percent. Corporate spending is also expected to increase again, but we may not see a significant boost in that area until the latter half of the year.

"Compared to 3Q09, the modest rise in shipments in 4Q09 indicates that the market is returning to normal seasonal patterns,” said Shane Rau, director of Semiconductors: Personal Computing research at IDC. "Compared to 4Q08, the huge rise in shipments indicates that the market has put the recession behind it. Both comparisons indicate that the PC industry anticipates improvement in PC end demand in 2010.”

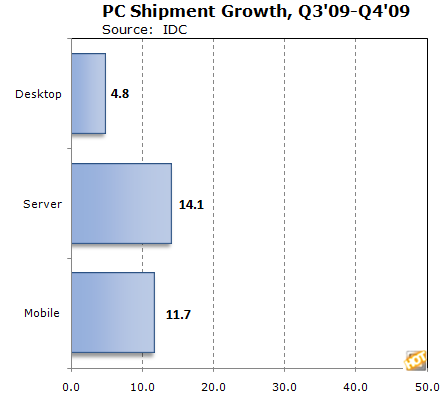

IDC's data matches statements we heard from both AMD and Intel on the current shape of the market. While all three segments grew, desktops lagged well behind mobile parts. The rise in server shipments caps a weak year in which consumer spending, not corporate refresh cycles, drove PC sales. This shift would also account for the drop in overall revenue; OEM margins tend to be significantly higher on business products than their home-oriented counterparts.

AMD apparently grabbed a bit of market share from Intel in Q4, thanks to improved product positioning and better mobile offerings, but Intel continues to dominate both mobile and workstation sales, with nearly 90 percent of both markets. One of the key components of AMD's antitrust suit against Intel was that the larger company used predatory pricing tactics to force AMD out of the more lucrative server and mobile arenas by refusing to offer highly discounted prices unless an OEM agreed to either purchase the vast majority of its CPUs from Intel (~90 percent) or agreed to delay/kill AMD products that might have otherwise competed. Now that the two companies have resolved their dispute and Intel has agreed not to engage in such practices, we may see Sunnyvale's market share edge upwards.

At present, IDC projects a return to seasonal trends for 2010 and expects the market to grow by about 15 percent. Corporate spending is also expected to increase again, but we may not see a significant boost in that area until the latter half of the year.