TSMC Predicts Slumping Sales Through 2012; May Dedicate Whole Fabs To Customers

TSMC's earnings call yesterday was a mix of good short-term news and uncertainty about the future. Company revenue grew 21% quarter-on quarter, gross margin was up one percent, and 28nm yields improved significantly as the foundry managed to wrangle the yield issues that've been driving companies like AMD and Nvidia quietly bonkers. This last point was confirmed in AMD's own conference call; CEO Rory Read characterized 28nm GPU supply as "strong," in contrast to earlier quarters.

On the down side, TSMC expects to see lower sales through calendar 2012's Q3/Q4 thanks to the weak global economy. This sentiment has been echoed by AMD and Intel, both of which have constrained their profit guidance on the assumption that neither Europe nor the US will see substantial recovery any time soon. The company's CEO, Morris Chang, predicts that revenue will recover thereafter -- and that TSMC may be ramping 20nm in very small volume by then.

Given the company's historic difficulty with such ramps, that prediction seems overly optimistic. While Morris can fairly claim that TSMC's 28nm ramp is ahead of where the 40nm ramp was at the same stage, TSMC's 40nm ramp was terrible to the point of being legendary. We wouldn't be surprised if the children of TSMC's foundry engineers were threatened with having to work on the 40nm ramp from the beginning if they don't eat their vegetables, brush their teeth, or discover a new method of doping silicon that increases its purity.

TSMC's profit breakdown, however, shows that 28nm is slowly capturing a higher percentage of the company's business, though Chang remarked that TSMC's gross margin on 28nm is below its margin on other products. That situation isn't expected to resolve until the end of the year, which is partly due to the weak economy and partly to the inherent difficulty of 28nm production.

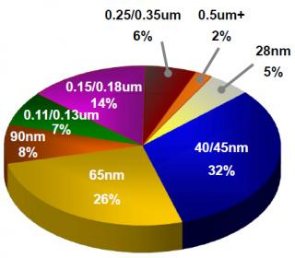

The interesting thing about these breakdowns is that it shows how slowly most companies move from node to node. Intel, AMD, Qualcomm, and Nvidia are the exceptions, not that rule. Although this chart is a revenue breakdown rather than a per-unit sales analysis, 40% of TSMC's revenue is generated by processes at least ten years old. Toss in 65nm, which debuted in 2006, and 65% of the company's sales by revenue are in what the PC world thinks of as "old tech."

That makes Chang's comments on TSMC's future fab buildouts particularly interesting. Asked whether TSMC would consider dedicating specific foundries to one particular customer, Chang responded:

Apple has inevitably been floated as a customer, but that's not the first place we'd look. Apple's arrangements with Samsung very nearly amount to a single-manufacture point already; Samsung's non-Apple business is only ~$300M. Qualcomm seems a more likely customer to make this jump, or possibly Nvidia. Regardless, it could signal a major shift in strategy for both the foundry and its major customers -- we'll look for more information as TSMC builds product at 20nm and below.

On the down side, TSMC expects to see lower sales through calendar 2012's Q3/Q4 thanks to the weak global economy. This sentiment has been echoed by AMD and Intel, both of which have constrained their profit guidance on the assumption that neither Europe nor the US will see substantial recovery any time soon. The company's CEO, Morris Chang, predicts that revenue will recover thereafter -- and that TSMC may be ramping 20nm in very small volume by then.

Given the company's historic difficulty with such ramps, that prediction seems overly optimistic. While Morris can fairly claim that TSMC's 28nm ramp is ahead of where the 40nm ramp was at the same stage, TSMC's 40nm ramp was terrible to the point of being legendary. We wouldn't be surprised if the children of TSMC's foundry engineers were threatened with having to work on the 40nm ramp from the beginning if they don't eat their vegetables, brush their teeth, or discover a new method of doping silicon that increases its purity.

TSMC's profit breakdown, however, shows that 28nm is slowly capturing a higher percentage of the company's business, though Chang remarked that TSMC's gross margin on 28nm is below its margin on other products. That situation isn't expected to resolve until the end of the year, which is partly due to the weak economy and partly to the inherent difficulty of 28nm production.

The interesting thing about these breakdowns is that it shows how slowly most companies move from node to node. Intel, AMD, Qualcomm, and Nvidia are the exceptions, not that rule. Although this chart is a revenue breakdown rather than a per-unit sales analysis, 40% of TSMC's revenue is generated by processes at least ten years old. Toss in 65nm, which debuted in 2006, and 65% of the company's sales by revenue are in what the PC world thinks of as "old tech."

That makes Chang's comments on TSMC's future fab buildouts particularly interesting. Asked whether TSMC would consider dedicating specific foundries to one particular customer, Chang responded:

Actually yes. I think that’s almost a natural outcome the way market is trending. I think that they are going to be larger customers, and now it makes complete sense to dedicate a whole fab to just one customer and hold that – to hold fabs in fact to just one customer. Now remember, we made our mark in serving many customers. In fact, that’s a really part of our secret source of success. The ability to serve many customers to their satisfaction and we’ll still will retain that capability, but there are customers that are getting bigger and bigger. So it makes sense that we dedicate a whole fab or even more than a whole fab to just one customer.That's a huge statement, particularly for a company that made its mark by providing foundry service to a widely disparate group of customers who sold their own foundries and agreed to use TSMC's. What it suggests is that the company is considering a business model which would, in certain cases, see it sharing risks and costs with customers willing to pay for their own particular manufacturing lines.

Apple has inevitably been floated as a customer, but that's not the first place we'd look. Apple's arrangements with Samsung very nearly amount to a single-manufacture point already; Samsung's non-Apple business is only ~$300M. Qualcomm seems a more likely customer to make this jump, or possibly Nvidia. Regardless, it could signal a major shift in strategy for both the foundry and its major customers -- we'll look for more information as TSMC builds product at 20nm and below.