Why Samsung Is Getting Hammered By Eroding Profits

Samsung will need its recently launched Galaxy S10 family to sell like gangbusters in order to rebound from a Q1 slump. The South Korean handset and electronics maker warned investors that its profit in the first quarter will be in the neighborhood of 6.1-6.3 trillion Korean won (~$5.36-$5.4 billion in US currency), which in a vacuum is pretty impressive. However, those figures represent a sizeable 60 percent decline from 15.64 trillion Korean won (~$13.76 billion) in the same quarter a year ago.

The company is to release its full earnings report in a couple of weeks, on April 30. In the meantime, we can look back at what Samsung wrote in a regulatory filing in March. In it, Samsung said it "expects the scope of price declines in main memory chip products to be larger than expected."

Samsung produces memory products for home PCs, servers, and smartphones. As it relates to all of that, not only is Samsung suffering from the usual seasonal downturn, but smartphone sales are slumping globally, which further affects memory chip sales. It's also having an impact on Samsung's display business.

"Inventories piling up on its memory chip side and weak performance of its display panels business due to bad sales in Apple's iPhones bring worse profitability for Samsung," Lee Won-sik, an analyst at Shinyoung Securities, told Reuters last month.

Samsung's updated guidance is also in line with numbers shared by International Data Corporation (IDC) last November. At the time, IDC said Samsung had come off a "challenging" quarter in which its smartphone shipments declined 13.4 percent to 72.2 million units.

That decline was indicative of a bigger trend affecting the smartphone industry at large, and not just Samsung's line of handsets. According to IDC, smartphone vendors combined to ship 355.2 million units in the third quarter of last year, resulting in a 6 percent year-over-year drop.

Samsung issued a similar warning in January for its fiscal fourth quarter of 2018, which it also attributed to weaker-than-expected memory chips. At the time, Mark Newman, managing director of Sanford C. Berstein, told CNBC that memory demand has really fallen off a cliff."

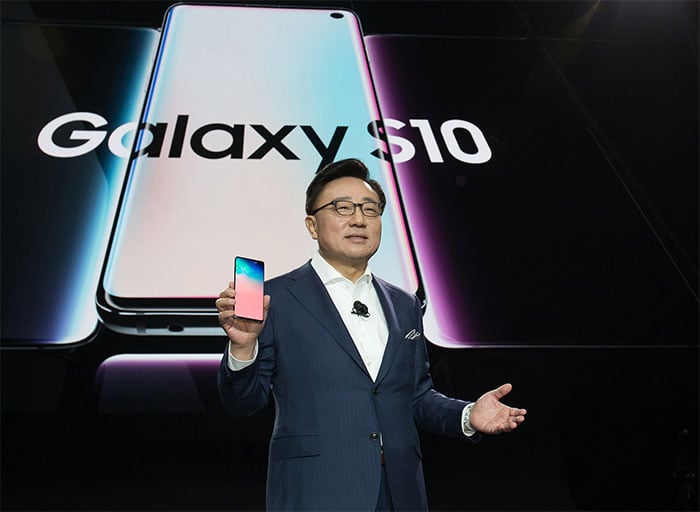

The good news for Samsung is that it has a new flagship smartphone line to bolster sales for the next quarter. In addition, it operates in multiple product categories, and as such is positioned to weather these types of storms. It just so happens that several of those product categories are intertwined, so it's not completely immune to dips in any particular sector.