ARM's Race: An Attack Plan For Servers and Mobile

The Changing Face of Mobile

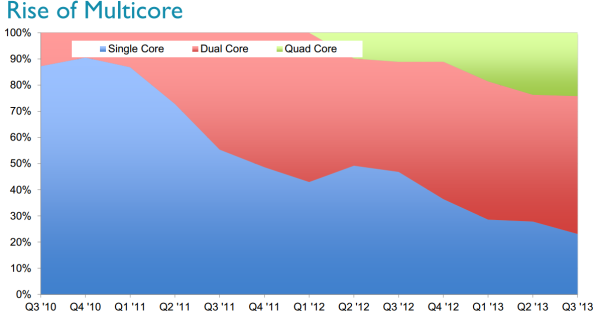

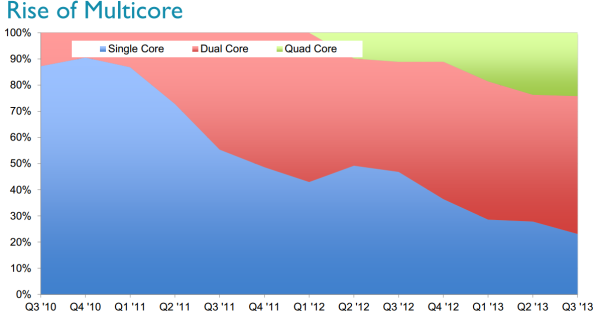

ARM continues to dominate the mobile and tablet markets despite mounting challenge from Intel in the Android tablet space, but the type and nature of the ARM products that cover this space has shifted a great deal since the first Cortex-A8 chips launched in 2008. Dual-cores ramped rapidly beginning in 2010, with quad-cores accounting for nearly 20% of the market by Q3 2013. More than just core counts, the cost of ARM devices has plummeted; a single-core Cortex-A5 device running Firefox OS is expected to sell for as little as $25. $50 is enough to buy a Chinese-branded 3G phone with a dual-core Cortex-A7.

That's small potatoes compared to the upper end of the Cortex family, but consider that the dual-core devices of 2010 went for $500-$600 unsubsidized and it illustrates just how quickly prices have dropped in this segment.

2014 will be the year that Android starts to seriously make an effort in 64-bit eveolution as well, and ARM was ready to show benchmark data in more detail than its previously disclosed. The company is claiming impressive boosts for various workloads in tests like Geekbench, with the Cortex-A57 expected to deliver between 12 - 33% faster performance in 64-bit mode.

The Cortex-A57 is also supposedly much faster than the Cortex-A15, even when running in 32-bit code. This slide also gives us a look at Cortex-A53 performance, which is a fairly steady 75-85% of Cortex-A15.

Multiple companies, including Qualcomm, have already announced upcoming products based on the Cortex-A53 SoC, and this performance data suggests the midrange smartphones built on that platform will still perform extremely well. MediaTek has made waves with its low-cost Cortex-A7 based hardware; other data ARM provided pointed to a nearly 50% performance gain for the Cortex-A53 compared to that processor.

TSMC was also on hand to present at the event, with the suggestion that we'll see shipping mobile hardware at 20nm in 2015 (already confirmed by launch announcements from Qualcomm and AMD), with 16nm FinFET arriving in 2016. Keep in mind, that arrival date reflects when TSMC expects the node to be ready for shipments, not when consumers will be able to buy hardware that uses the new process. GPUs tend to launch fairly quickly after a node is validated for volume production, but SoCs can take an additional 9-12 months of validation.

TSMC expects to launch a 16nm FinFET update (dubbed 16nm FinFET+) shortly after it debuts 16nm FinFET, with the new node offering a further 15% performance increase. In theory, we could see hardware using this process by late 2016 or early 2017. Intel should be well into its 10nm rollout by that time, assuming that the company continues at its previous cadence after the 14nm delay it took earlier in the year.

The last thing to note in mobile is how much a topic of conversation Intel wasn't. While ARM did have some performance slides to show regarding claimed advantages over Santa Clara, the overall focus was on the company's own roadmap and plans for these segments. That's perfectly understandable in mobile, where Intel's attempts to gain dominance have largely stalled, but in server it may reflect a lack of mature products and benchmark results to go head-to-head between the two platforms. We expect such comparisons to be eyed keenly by both sides as they emerge -- Intel will fight tooth and nail to retain market share across the server space, as will ARM on the mobile battlefront.

The last thing to note in mobile is how much a topic of conversation Intel wasn't. While ARM did have some performance slides to show regarding claimed advantages over Santa Clara, the overall focus was on the company's own roadmap and plans for these segments. That's perfectly understandable in mobile, where Intel's attempts to gain dominance have largely stalled, but in server it may reflect a lack of mature products and benchmark results to go head-to-head between the two platforms. We expect such comparisons to be eyed keenly by both sides as they emerge -- Intel will fight tooth and nail to retain market share across the server space, as will ARM on the mobile battlefront.

That's small potatoes compared to the upper end of the Cortex family, but consider that the dual-core devices of 2010 went for $500-$600 unsubsidized and it illustrates just how quickly prices have dropped in this segment.

2014 will be the year that Android starts to seriously make an effort in 64-bit eveolution as well, and ARM was ready to show benchmark data in more detail than its previously disclosed. The company is claiming impressive boosts for various workloads in tests like Geekbench, with the Cortex-A57 expected to deliver between 12 - 33% faster performance in 64-bit mode.

The Cortex-A57 is also supposedly much faster than the Cortex-A15, even when running in 32-bit code. This slide also gives us a look at Cortex-A53 performance, which is a fairly steady 75-85% of Cortex-A15.

Multiple companies, including Qualcomm, have already announced upcoming products based on the Cortex-A53 SoC, and this performance data suggests the midrange smartphones built on that platform will still perform extremely well. MediaTek has made waves with its low-cost Cortex-A7 based hardware; other data ARM provided pointed to a nearly 50% performance gain for the Cortex-A53 compared to that processor.

TSMC was also on hand to present at the event, with the suggestion that we'll see shipping mobile hardware at 20nm in 2015 (already confirmed by launch announcements from Qualcomm and AMD), with 16nm FinFET arriving in 2016. Keep in mind, that arrival date reflects when TSMC expects the node to be ready for shipments, not when consumers will be able to buy hardware that uses the new process. GPUs tend to launch fairly quickly after a node is validated for volume production, but SoCs can take an additional 9-12 months of validation.

TSMC expects to launch a 16nm FinFET update (dubbed 16nm FinFET+) shortly after it debuts 16nm FinFET, with the new node offering a further 15% performance increase. In theory, we could see hardware using this process by late 2016 or early 2017. Intel should be well into its 10nm rollout by that time, assuming that the company continues at its previous cadence after the 14nm delay it took earlier in the year.

The last thing to note in mobile is how much a topic of conversation Intel wasn't. While ARM did have some performance slides to show regarding claimed advantages over Santa Clara, the overall focus was on the company's own roadmap and plans for these segments. That's perfectly understandable in mobile, where Intel's attempts to gain dominance have largely stalled, but in server it may reflect a lack of mature products and benchmark results to go head-to-head between the two platforms. We expect such comparisons to be eyed keenly by both sides as they emerge -- Intel will fight tooth and nail to retain market share across the server space, as will ARM on the mobile battlefront.

The last thing to note in mobile is how much a topic of conversation Intel wasn't. While ARM did have some performance slides to show regarding claimed advantages over Santa Clara, the overall focus was on the company's own roadmap and plans for these segments. That's perfectly understandable in mobile, where Intel's attempts to gain dominance have largely stalled, but in server it may reflect a lack of mature products and benchmark results to go head-to-head between the two platforms. We expect such comparisons to be eyed keenly by both sides as they emerge -- Intel will fight tooth and nail to retain market share across the server space, as will ARM on the mobile battlefront.