Samsung Retakes Top Smartphone Spot From Apple, Has iPhone Fatigue Set In?

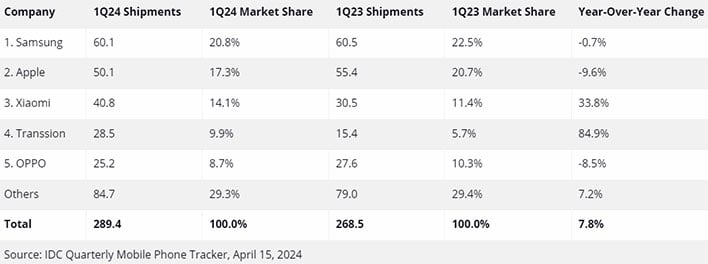

Apple ended 2023 with bragging rights over Samsung by boasting the biggest share of the global smartphone market, but turns out it was a short-lived victory. According to the latest shipment and market share figures shared by IDC Research, Samsung is back in the top spot after iPhone sales slumped by nearly 10% to 50.1 million units in the first quarter of 2024.

That's good for a 17.3% share of the overall smartphone market, which is enough to sit in second place ahead of Xiaomi (14.1%), Transsiion (9.9%), and Oppo (8.7%). All others combined make up the remaining 29.3%. Meanwhile, Samsung is sitting pretty in the top spot with a 20.8% share of the smartphone market after shipping 60.1 million Galaxy devices in the first quarter.

"While Apple managed to capture the top spot at the end of 2023, Samsung successfully reasserted itself as the leading smartphone provider in the first quarter. While IDC expects these two companies to maintain their hold on the high end of the market, the resurgence of Huawei in China, as well as notable gains from Xiaomi, Transsion, OPPO/OnePlus, and Vivo will likely have both OEMs looking for areas to expand and diversify," said Ryan Reith, group vice president with IDC's Worldwide Mobility and Consumer Device Trackers.

The continued jostling between Samsung and Apple comes amid signs of a recovery in the smartphone sector, with global smartphone shipments increasing 7.8% year-over-year to 289.4 million units in the first quarter, according to IDC's latest smartphone report. However, IDC says "the industry is not completely out of the woods" due to lingering macroeconomic challenges. That said, this is the third quarter in a row that smartphone shipments have increased.

"The smartphone market is emerging from the turbulence of the last two years both stronger and changed," said Nabila Popal, research director with IDC's Worldwide Tracker team. "Firstly, we continue to see growth in value and average selling prices (ASPs) as consumers opt for more expensive devices knowing they will hold onto their devices longer. Secondly, there is a shift in power among the Top 5 companies, which will likely continue as market players adjust their strategies in a post-recovery world."

Whether or not iPhone fatigue is setting in, as we questioned in our headline, is something that remains to be seen. The iPhone 15 series is approaching seven months on the market. While it's possible that some among the Apple faithful are waiting on the iPhone 16, it's a little surprising to see a 9.6% decline in iPhone shipments, especially given how well the iPhone 15 has been received.